Green Transition Leads the Metal Market

At the end of 2025, the non-ferrous and ferrous metal sector in the commodity market is showing a robust “multi-point blooming” momentum. Copper and aluminum, as leading varieties, have seen significant price gains, with other key metals such as lead, zinc and nickel also moving upward in tandem. The enthusiasm in both futures and spot markets has formed a resonance. This metal price rally is not a short-term speculation driven by capital, but a “solid logic” built by supply-demand gaps, policy support, and new energy demand, which is reshaping the overall pattern of the global metal market.

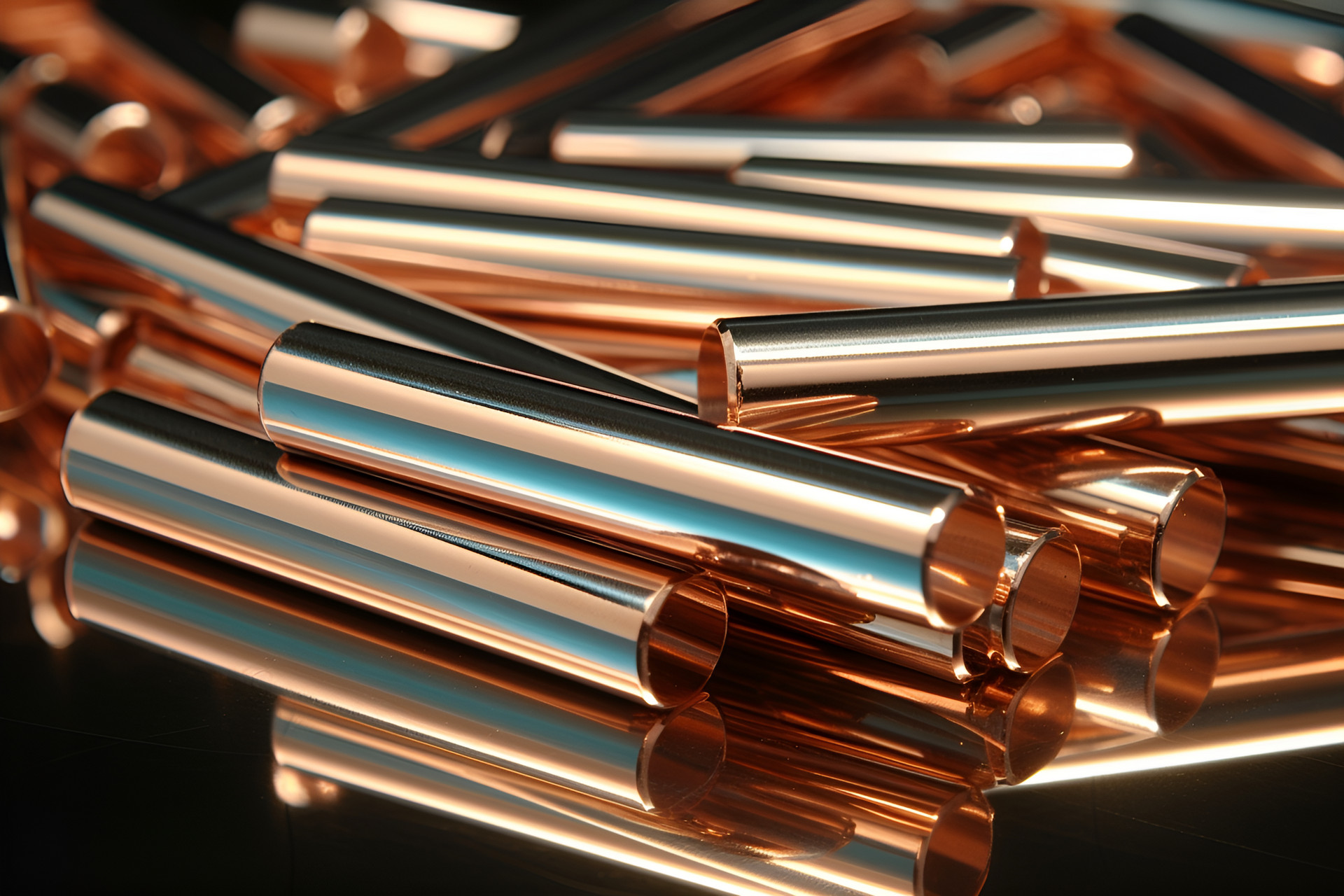

Rigid constraints on the supply side have provided systematic support for metal markets. In the non-ferrous metal sector, China’s electrolytic aluminum production capacity is strictly capped by policies, with operating rate approaching full capacity. The copper market, on the other hand, is plagued by a “ore shortage”: the annual growth rate of global copper ore output lags far behind demand growth, and the declining grade of old mines in major producing countries has extended the commissioning cycle of new mines. On the ferrous metal front, production restrictions in major pig iron producing areas due to environmental protection requirements continue. The lead-zinc market also faces resource bottlenecks—supply disruptions in key mining regions have led to a sharp drop in treatment charges, creating a superimposed effect of tight supply across multiple varieties.

Structural changes on the demand side are the core driving force behind the differentiation and upgrading of the metal market. The traditional demand logic, once dependent on the real estate sector, has been broken. The new energy industry has become the “main engine” of metal consumption—new energy vehicles not only drive demand for copper and aluminum (with 283 kg of aluminum per vehicle and 3-4 times more copper consumption than fuel vehicles) but also activate demand for minor metals such as nickel and cobalt, with nickel demand for power batteries growing at an annual rate of over 40%. In the photovoltaic sector, each GW of installed capacity consumes 13,000 tons of aluminum and 8,000 tons of copper. The copper consumption of server equipment in computing centers is three times that of ordinary servers, and each kilometer of ultra-high voltage transmission lines uses 50 tons of copper. The power and new energy sectors now account for half of the total demand for copper and aluminum. Meanwhile, the upgrading of machinery manufacturing has driven demand for high-strength steel and special alloys, forming multiple growth drivers in the metal market.

Policy coordination and the macroeconomic environment have jointly consolidated the confidence foundation of the metal market. Domestically, policies such as the “Non-Ferrous Metal Industry Steady Growth Plan” and the “Iron and Steel Industry Ultra-Low Emission Transformation Guidelines” have been intensively introduced. Through production capacity control and higher environmental protection standards, vicious competition in the industry has been effectively avoided, driving significant improvement in enterprise profitability—Aluminum Corporation of China (Chinalco) achieved a record-high net profit in the first three quarters. Internationally, the continuous decline of the U.S. dollar index has boosted internationally traded metals, and the growing expectation of interest rate cuts by the Federal Reserve, coupled with global low-carbon transformation demand, has further enhanced the attractiveness of metal assets.

Despite the overall positive outlook, the metal market still needs to be vigilant against structural risks and external variables. Substitution effects between varieties are emerging—high copper prices have accelerated the adoption of “aluminum instead of copper” in certain application scenarios. Uncertainties in the global supply chain remain: the slower-than-expected recovery of metal smelting capacity in Europe and adjustments to Indonesia’s nickel ore export policies may trigger price fluctuations. However, in the long run, the supply-demand gap in the metal market will further widen in 2026. Leading metals like copper and aluminum will maintain an upward trend, while minor metals related to new energy are expected to see more prominent growth, keeping the entire metal sector in a high boom cycle.